Photo by David Greene

The following is an extended version of the story that appears in our latest print edition.

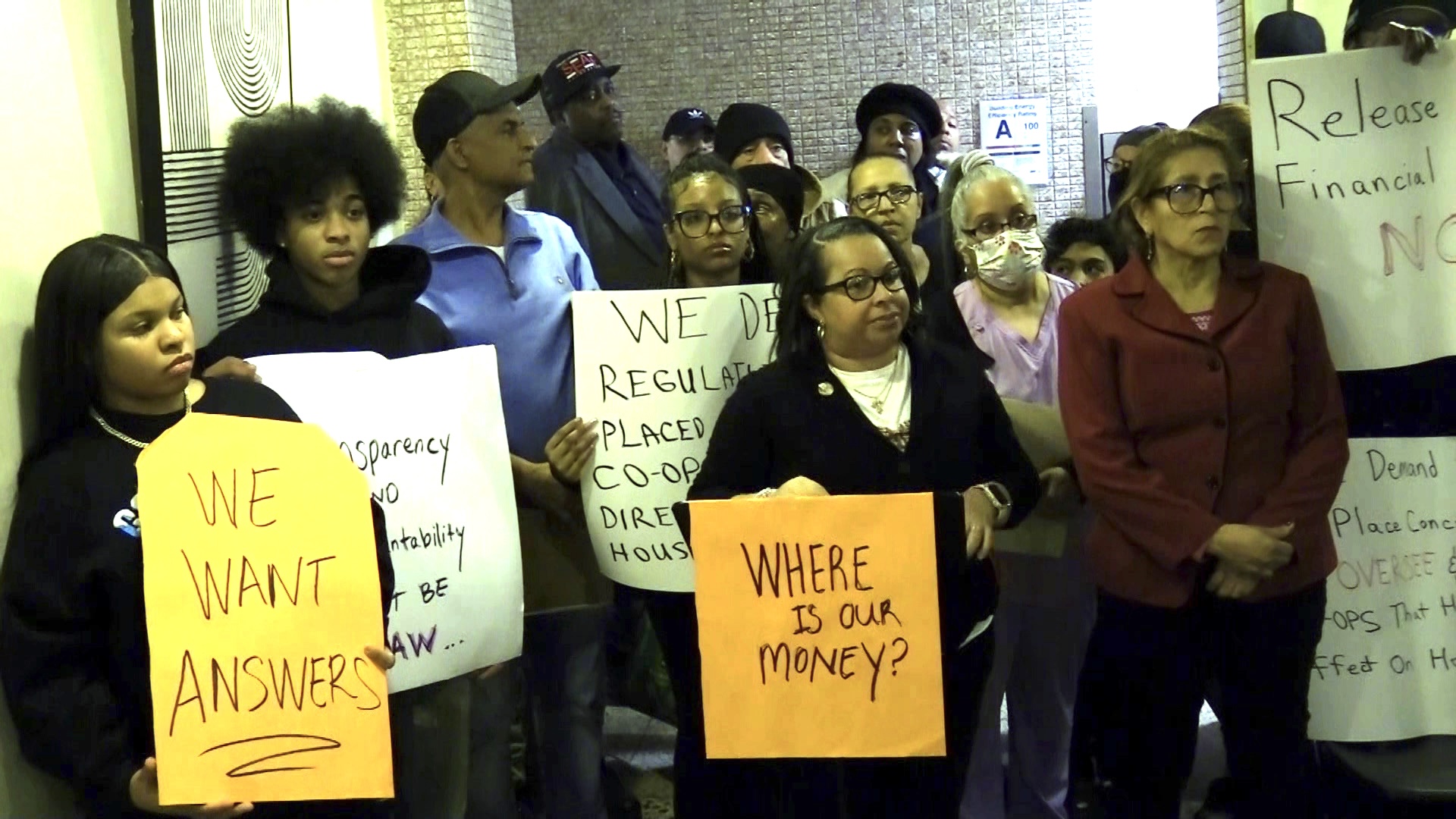

A few dozen shareholders of a private cooperative located in Norwood await the results of a promised audit of the co-op’s finances, after they say they were hit at short notice with what they see as steep maintenance fee increases, and dispute certain prior decisions taken in relation to the finances. The move follows a recent ownership shake-up which has seen a replacement majority co-op shareholder in the mix.

Prior to the promise of an audit, the minority shareholders had demanded they be granted permission to examine the co-op’s accounting records, and alleged they also did not know the names of all the officers on the board of directors of the co-op.

During a special meeting of 3520 Tryon Avenue Owners, Inc. held on Jan. 23, shareholders, including some seniors, had packed the lobby of the co-op building and had voted unsuccessfully to remove the co-op board president, Sheila Graham, as a member of the board of directors. At the time, shareholders were infuriated over a previously announced 6% increase in monthly maintenance fees that went into effect on Feb. 1, after being given just 13 days’ notice.

Alina Dowe, a co-op shareholder who also happens to be the Bronx borough director of the community affairs unit for New York City Mayor Eric Adams, alleges Graham and the board took out a $2.2 million mortgage in October 2023, without informing board members or shareholders.

For its part, the board and the president deny any wrongdoing and their legal representatives say any documents signed by the president were signed in her capacity as a representative of the board.

Dowe went on to allege that $742,000 of equity was withdrawn from the co-op’s finances, on top of an $80,000 withdrawal that was targeted to go into an escrow account to satisfy an unpaid $106,000 Con Edison bill.

According to investopedia.com, mortgage equity withdrawal (MEW) is the removal of equity from the value of a home through the use of a loan against the market value of the property. A mortgage equity withdrawal reduces the real value of a property by the number of new liabilities against it.

Shareholders’ equity (or owners’ equity for privately held companies) represents the amount of money that would be returned to a company’s shareholders if all of the assets were liquidated and all of the company’s debt was paid off in the case of liquidation. In the case of acquisition, it is the value of company sales minus any liabilities owed by the company not transferred with the sale.

Dowe would later also allege that an additional $300,000 line of equity was withdrawn several years ago to pay for the replacement of the building’s windows. Shareholders allege the windows were never replaced.

Dowe told Norwood News that when shareholders found out about the maintenance fee increase and had concerns over the refinancing and other financial matters, they called for the January meeting with the board of directors with the intention of voting Graham out as president.

Photo by David Greene

At the Jan. 23 meeting, attorney Ronald Sher of Himmelfarb & Sher, LLP, based in White Plains, NY, spoke to shareholders on behalf of Jobber Bronx & Yonkers LLC, later identified by Sher as the new majority shareholder, which he said is managed by MD 2 (Squared).

Ahead of the unsuccessful vote to remove Graham at that January meeting, a shareholder had asked who had appointed Graham as president. “Board members vote for the officers,” Sher explained. “Shareholders vote for the members of the board, unless there is a vacancy and the board has the right to fill that vacancy, based upon… ” He was then cut off by people talking over each other.

Accordingly, the vote taken was actually to remove Graham as a board member, not as president, and as above, it was defeated. Dowe later said that with the way the voting process works, “There’s not enough owners in the building that could ever equate to a super majority.”

Meanwhile, the shareholders expressed their outrage at the meeting that Sher and the board had hired both a ballot counting company, Honest Ballot, to oversee the planned vote at the meeting, as well as a security guard who they were told was there to watch over the meeting and protect board members.

Dowe said Sher informed shareholders that the associated costs for hiring both the security guard and the ballot counting company would be passed on to shareholders. Defending his rationale for the move, Sher told the crowd, “We were concerned that this meeting would be disrupted.”

In the context of the recent refinancing, Sher blamed the former management company, who he said handled the day-to-day operations of the co-op, for not sending out a notice about it to shareholders. “We asked management…. to send out a notice to everybody about the refinancing,” he said. “It appears that that did not happen, but that’s not the board’s fault.” Norwood News contacted the former management company for comment and will share any feedback we receive.

At one stage during the meeting, Gina Costello Williams, the Bronx borough advocate for NYC Public Advocate Jumaane Williams, began to tell shareholders about three new bills introduced at City Council in February 2023, [Intros 915, 914, and 917] by the public advocate and City Council Member Pierina Sanchez (C.D. 14).

Sanchez represents a neighboring council district of The Bronx, but not Norwood, which is represented by City Council Member Eric Dinowitz (C.D. 11). The aims of the bills is to foster transparency around co-op management. As Williams was speaking about them, Sher intervened, saying, “We support this law!” His retort drew angry shouts and some profanities from the crowd, prompting Sher to respond, “This is why we need guards!”

Dowe said that Sanchez had informed her earlier that day that the pending bills were to be amended to ensure that existing shareholders, in addition to any new shareholders entering into the co-op, would receive information regarding the co-op’s state of finances at that juncture.

Shareholders are now reaching out to elected officials to have the bills referenced by Costello Williams passed. They reportedly will require the board of directors to provide shareholders with monthly financial reports and a minimum of six months’ notice of any planned maintenance fee increases.

In an email issued by shareholders ahead of the January meeting, they said these bills, “will aid in ensuring transparency and accountability, which is crucial for the shareholders’ peace of mind and the overall stability of the co-ops.”

Photo by David Greene

In response to questions about the co-op’s finances from shareholders, Sher said in part, “Your mortgage was going to mature in November 2023; it was all going to be due. We had to go to another bank and get the money to pay them off and we took additional money for further closing costs and capital improvement projects for the reserve fund to be performed over the next 10 years.”

At one stage, Sher introduced Jacob Black, an accountant, who he said had been hired by the board as an independent auditor of the co-op’s finances over many years, and asked him to address the shareholders. “The last time we did a financial statement was at the end of 2022,” the accountant said, adding that there might have been a zoom meeting to discuss it at the time but that he couldn’t recall off-hand.

Black added that he knew there had been a lot of activity regarding the co-op’s finances since that date, that as of the Jan. 23 meeting, he was in the midst of audit season [for financial year-end Dec. 31, 2023], and that he wasn’t sure which numbers the shareholders wanted him to give an update on. He shared that as of Dec. 31, 2022, when the financial statement was issued, there were no calls made to his office about it.

Referring to the familial nature of his accounting firm, he said the shareholders were like family to him, that the January meeting was the first he had attended that was not an AGM, and the fact that a special meeting had to be called saddened him.

In response to a question by Sher about the shareholders’s concerns over the management of the co-op’s finances by the board, Black said the scope of his role as independent auditor was primarily to examine what the management records show, what the bank shows, and to send out third party confirmations to entities like mortgage companies and insurance companies, etc. He confirmed he had shared his findings with the prior management company.

On April 17, Norwood News asked Sher to further clarify the ownership structure of the co-op. He explained that 3520 Tryon Avenue Owners, Inc., “is a residential cooperative corporation that is owned by shareholders based upon their respective certificates of stock.”

Referring to the prior majority shareholder, he added, “The sponsor / holder of unsold squares sold the apartments to an entity identified as Jobber Bronx & Yonkers, LLC, which is managed by MD 2 (Squared).” Norwood News requested confirmation of when this happened from Sher. We will share any updates we receive.

Sher also said that the co-op is currently managed by Westchester Property Management Group, Inc., and the accounting firm of Schulman & Black, and that Sher’s firm, Himmelfarb & Sher, LLP, is retained as corporate counsel, representing the co-op.

In reference to the various concerns raised by shareholders about the co-op’s finances, Sher continued, “The Board of Directors specifically asserts that it acted in compliance with its fiduciary duties and fiscal responsibilities as set forth in the by-laws and categorically denies and strenuously disputes any and all allegations of wrongdoing involving depletion of equity or financial impropriety or malfeasance.”

He went on to say, “The Board of Directors has approved a forensic audit to be conducted by a certified fraud examiner / CPA. Additionally, the management agent has negotiated a payment plan with Consolidated Edison. Accordingly, we will keep the shareholders apprised of the status of the forensic audit.”

On April 18, Sher added, “The shareholders submitted a report to the NYSAG [The Office of New York State Attorney General Letitia James] regarding their claims and we have previously requested specific evidence or documentations of alleged impropriety or financial wrongdoing so that we can present same to NYSAG of Bronx County District Attorney. We certainly look forward to working together on this matter.”

On April 30, in response to some follow-up questions, Sher added, “Please note that the Board of Directors properly authorized and duly approved the Mortgage Refinancing by the corporation. In accordance with the foregoing, the Lender requires an officer of the Corporation to execute the mortgage and loan documents in order to legally and lawfully effectuate same. Moreover, the members of the Board of Directors, pursuant to its fiduciary duties and fiscal responsibilities, based upon the ByLaws, duly approved and authorized the President to sign, as required by the Lender.”

Photo by David Greene

He continued, “Please note that the ByLaws specifically provide enabling power for an officer to execute and sign such mortgage and loan documents. Accordingly, Pres. Sheila Graham acted in a proper and lawful manner, solely in her official corporate capacity, not as an individual.”

Norwood News has asked the shareholders to share the outcome of the report from the New York Attorney General.

We previously reported on dissatisfaction by some private co-op shareholders with the Board of Directors of Fordham Hill Owners Corporation, located at 2 Fordham Hil Oval in Fordham Manor, in relation to prior fee increases and other matters.

*Síle Moloney contributed to this story.