Photo by Adi Talwar

By DAVID CRUZ

When Sally Dunford, executive director of West Bronx Housing, learned a multi-billion dollar conglomerate snatched up a portfolio of Bronx buildings through a city deal, she began scratching her head.

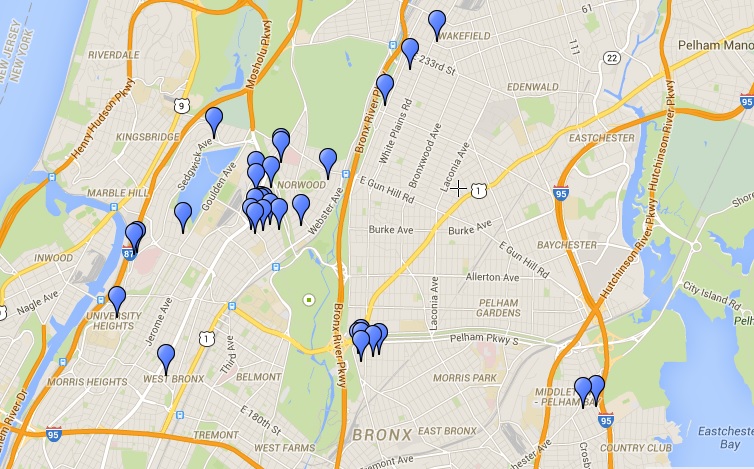

On its surface, the portfolio of 36 properties, mainly from the northwest Bronx, was managed by Simply Better Apartment Homes. The buildings have since experienced a widespread heat problem that, while being addressed, has inconvenienced several thousand tenants during the coldest months of the year.

But there were more layers. Behind the management agency is the owner–The Related Companies–a real estate firm with assets totaling between $22 to $15 billion.

Image courtesy Scribble Maps/Google Maps

But behind that is the New York City Pension Fund, a collection of retirement fund investments totaling $160.7 billion. It was the Pension Fund that gave Related Companies funds to purchase the portfolio for $253 million. The funds were cleared by the Pension Funds’ Board of Trustees with then Comptroller John Liu honoring it. The investment was also okay with current Comptroller Scott Stringer.

For Dunford, neither the city Buildings Department website nor the Housing Preservation and Development Department website listed the Pension Fund as the investor of the properties. She would learn that via news media.

Dunford, whose group serves as a watchdog for housing matters, spent months keeping track of heat complaints by tenants, who also endured days and nights of layering up in their homes, turning on their oven for heat or skipping showers.

And with issues that linger for the portfolio of buildings, Dunford suspects the investment was not in the city’s best financial interests.

“I am surprised that [the city] is not doing their due diligence,” said Dunford. “They are allowing an investment in a company that’s actually hurting some of their own members.”

News of the widespread problems put a spotlight on the manner in which the New York City Pension Fund screens its long-term investments, which include real estate deals. The Pension Fund is divided into five separate pensions for city employees, teachers, police officers, firefighters and retired Board of Education employees. In all, about 700,000 retirees and beneficiaries rely on the fund. Employees pay into their pension while employed with the city to help fund their retirement.

The New York City Comptroller’s Office serves as the investment advisor and monitor of the funds, partnering with the office’s Bureau of Asset Management to ensure any investment can produce a healthy rate of return.

Strategizing

Investment strategies vary according to a consensus reached by the Board of Trustees for each Pension Fund. Taken together, real estate deals fall under Real Assets, one of seven categories the funds invest in yearly. Currently, real estate investments represent $5.8 billion or 3.5 percent of the city’s total investment portfolio. It’s a small sum compared to the $60.4 billion in U.S. equity the Pension Funds invest.

But in recent years, the Pension Funds have upped their value of investments in Real Assets. A review of Real Assets in the last five years shows a steady percentage increase in performance.

Typically, the city publicly issues Requests for Proposal through the New York City Comptroller’s office website. It offers a qualified real estate firm the chance to buy property utilizing city pension funds so long as their proposal is sound.

After Superstorm Sandy, the city was intent on ensuring there was enough affordable housing, given the storm’s wave of destruction on shoreline communities. Related was awarded the RFP to purchase workforce housing, part of a broader $500 million plan to restore housing options in Sandy-battered neighborhoods. Related found that in SW Management, whose tenants are mostly working class.

A spokesman for New York City Comptroller Stringer said Related was awarded the investment management contract in December 2012. There were no specifics on how Related was vetted on the Comptroller’s website, with no public documents readily available, leaving the process vague.

Vetting Process

Normally, Trustees for each of the Pension Funds review several factors on an investment before moving forward. That includes economic risk, return, and performance, according to the Pension Funds website. The Trustees then issue their recommendation to the Funds’ respective advisors to execute the transaction.

In the case of Related, it’s unclear what criteria the firm met, sparking a phone call and litany of questions from Dunford to Comptroller Stringer’s office.

“The question is: what did Related promise in their proposal?” asked Dunford.

Related has been in the real estate market for over four decades, owning 43,000 units citywide units that have not been divested from its portfolio of affordable housing units. The company was initially known for buying multi-family housing for long-term investment, according to its website.

But an advantage for the city in business with a real estate firm is its ability to serve as a go-between for tenant/landlord disputes, a move Comptroller Stringer’s office made when it learned of heat complaint issues. Shortly after residents called Stringer’s office to complain, staffers reached out to Related “to substantiate any problems.”

“We are currently working with all parties to resolve any issues,” Stringer said in a statement.

But Stringer’s office declined to explain if any contingencies are in place should a real estate investment deal go under, consequently putting tenants at risk.

Management sucks they don’t know how to deal with their buildings I live in one and they don’t give heat you get heat in the morning then no more heat all day you call 311 there no help, we pay all this rent to be cold in our apartment we have elderly tenants that are cold and they don’t care they should move there elderly parents in these building to see how we are living. the office on 170 street in Bronx suck the manager Jamie does not know what she is doing at all they need to hire someone with knowledge. tenants are buying heater to keep warm that’s a shame we pay all this rent they control the heat my super has been in my building for over 40 years and they had no respect for him they tell tenant to tell the super there is no heat and if he raises the heat she calls him and tells him he is not allow to do that but yet they tell you to tell him this way people don’t call them that’s how slick they are, you call they send you to voice mail they don’t want to hear anything they should all be fired